Ok, take a deep breath in. Close your eyes and let it out slowly. We are getting through this. You are getting through this. Let’s do everything that we can to ensure businesses can weather this storm.

THBC is dedicated to the success of business. Right now, that might be guiding you towards helpful community resources, sharing ideas, or providing you useful information.

For others, you may require more personalized service specific to your business needs. Maybe you need to convert quickly to a virtual workspace. Or need creative solutions for keeping your customers, while protecting them and yourself. Here’s more information on how we can personally help your business.

Health and government officials are working together to maintain the safety, security, and health of the American people. Small businesses are encouraged to do their part to keep their employees, customers, and themselves healthy and safe.

That’s great! BUT I HAVE NO MONEY! What should I do?

Let’s talk about COVID-19: Small Business Guidance & Loan Resources.

SBA Economic Injury Disaster Loan Program

All U.S. small business owners who are adversely impacted by the coronavirus pandemic are currently eligible to apply for a low-interest loan due to COVID-19. The U.S. Small Business Association (SBA) is coordinating this effort at the state level.

Whether your business is for profit or nonprofit, if it has been severely impacted by COVID-19, the SBA’s Economic Injury Disaster Loan program provides small working capital loans of up to $2 million. This can provide vital economic support to help overcome the temporary loss of revenue we’re experiencing.

Loans can be used to pay fixed debts, payroll, accounts payable, and other bills that can’t be paid due to the disaster.

Interest rates:

- 3.75% small businesses for profit

- 2.75% non-profits

Long-term repayment of the loan is possible. The SBA understands that the loan payments must be kept as low as possible. Terms are decided on a case-by-case basis, based on the borrower’s ability to repay the loan. There is a 30-year maximum term.

We’ve put together handy guides to help! Please feel free to download and share (right click and select “Save Image”).

START HERE: Instructions by Entity Type

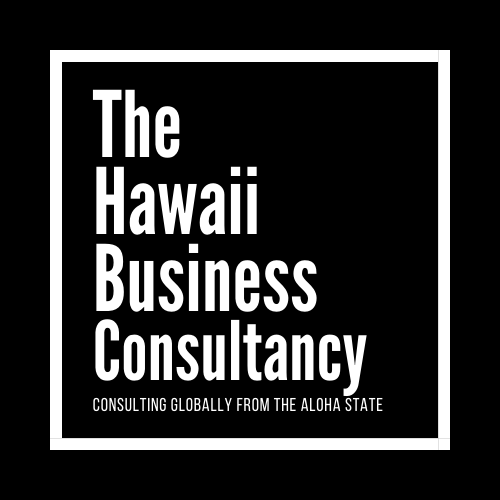

All applicants (except NPOs)

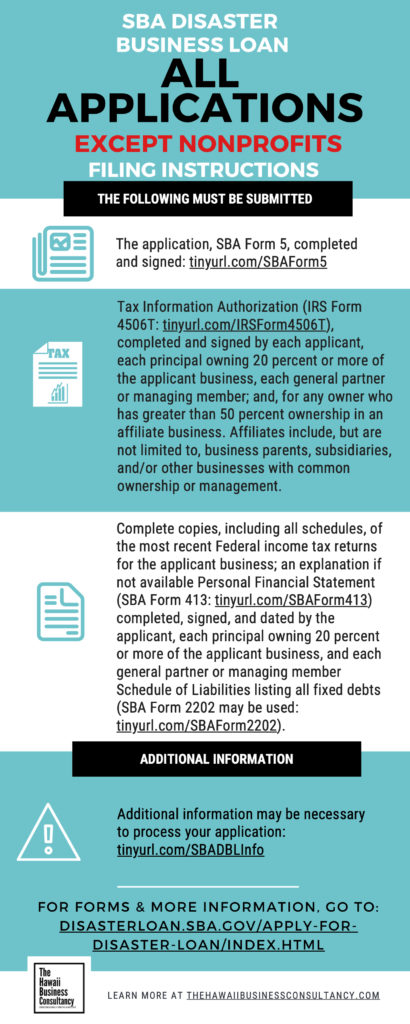

MILITARY

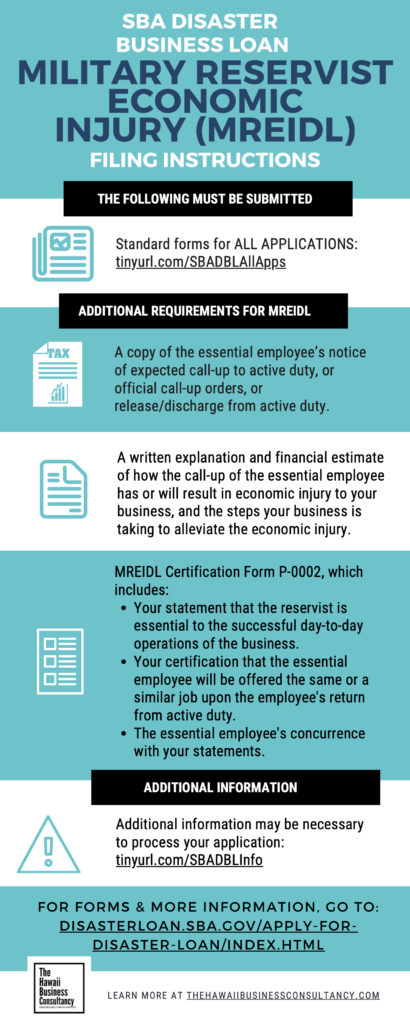

Nonprofits

Visit SBA.gov/Disaster for more information and to apply.