On Friday, March 27, 2020, the House of Representatives passed the Coronavirus Aid, Relief and Economic Security Act (CARES ACT). The President has signed it into law.

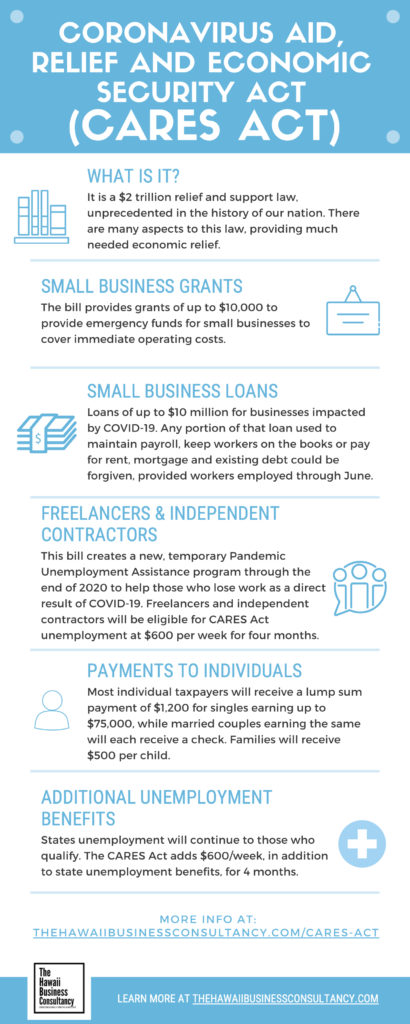

What is it? It is a $2 trillion relief and support law, unprecedented in the history of our nation. There are many aspects to this law, providing much needed economic relief.

This article outlines the CARES ACT as it relates to small businesses and individuals.

How does it apply to my business?

This covers small business owners, 501(c)(3) nonprofit organizations, sole proprietorships and self-employed individuals.

Emergency grants: The bill provides grants of up to $10,000 to provide emergency funds for small businesses to cover immediate operating costs.

Relief for existing loans: There is $17 billion to cover six months of payments for small businesses already using SBA loans.

Loans: The SBA is providing loans of up to $10 million for businesses impacted by COVID-19. Any portion of that loan used to maintain payroll, keep workers on the books or pay for rent, mortgage and existing debt could be forgiven, provided workers stay employed through the end of June.

What if I already laid off my employees? It’s not too late! You’ve got a short period of time to correct!

For temporary workforce and wage and salary reductions between February 15 through 30 days after the passage of the CARES ACT: The amount forgiven will not be reduced if workforce and wage and salary reductions are eliminated by June 30, 2020.

Freelancers & Independent Contractors

This bill creates a new, temporary Pandemic Unemployment Assistance program through the end of 2020 to help those who lose work as a direct result of COVID-19. Freelancers and independent contractors will be eligible for CARES Act unemployment at $600 per week for four months.

Payments to Individuals

Most individual taxpayers will receive a lump sum payment of $1,200 for singles earning up to $75,000, while married couples earning the same will each receive a check. Families will receive $500 per child.

There’s a sliding scale credit for incomes between $75,000-$99,000 for singles and $150,000-$199,000 for couples.

The key is that it’s based on your most recent tax return, so 2019 if you filed already or 2018 if you haven’t. You’ll want to check on:

- File your 2018 taxes if you haven’t already

- Check the “direct deposit” option

Additional Unemployment Benefits

States unemployment will continue to those who qualify. The CARES Act adds $600 per week, in addition to state unemployment benefits, for four months.

Although no one knows for sure when this money will be received, we do know that it’s going into direct deposit. The government says that they want to get this into taxpayer hands in about three weeks.

For more information, check out this NPR article.